You need to identify the quantity of costs you would certainly have to pay with a greater deductible and identify if those financial savings would be worth it. cheaper car insurance. Otherwise, it's far better to pay higher premiums for a reduced financial risk, specifically if your car's well worth is low. Points to Think About When Picking In Between Vehicle Insurance Policy Deductibles $500 or $1,000 As stated over, it's important to do your homework and compare the premium quantity with an additional deductible to locate the right alternative on your own.

In addition to the $500 as well as $1000 deductibles, insurance coverage carriers use various other choices that could be a lot more appropriate for you (cheapest auto insurance). You may be attracted to opt for the lower premium, yet you need to take into consideration the costs you would certainly need to bear in case of a crash. You might not be able to obtain the damages covered if you go with a $2,500 insurance deductible without having adequate funds to cover the price.

If you own continuous insurance as well as have a great driving document, reducing your deductibles could just include around $20 to the regular monthly bill. If you had a mishap and also filed a collision case, you've conserved $760. In conclusion, you require to go a lengthy time without a crash case to make your $1000 deductible worthwhile.

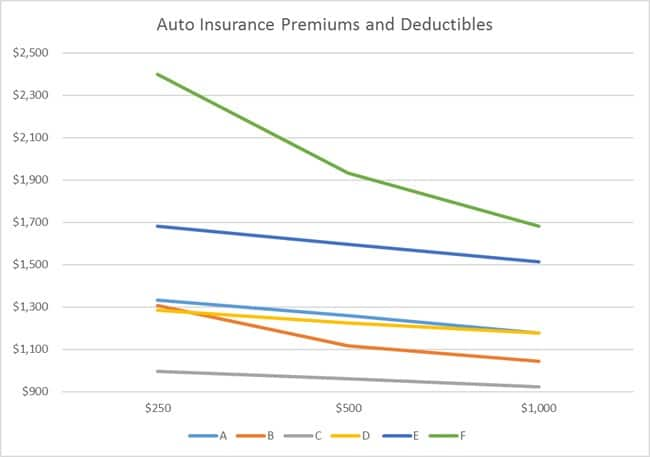

The lower the deductible cost, the greater the quantity of costs you'll need to pay every year. The deductibles begin with $250. It's best to consult your vehicle insurance carrier to obtain the appropriate offer, depending on your situation (cheapest auto insurance). The repayment is an additional point to think about when you are deciding on the deductible amount.

About What Is A Deductible? - Insurance Dictionary

As an example, if you switch over from $500 to $1000 insurance deductible, you'll save 10% on your premiums each year. With a $500 insurance deductible, your annual costs would have been $800 - cheapest. Nevertheless, it's mosting likely to be $720 with a $1000 deductible rather. Currently that you have actually increased your insurance deductible by $500, your yearly cost savings amount to $80.

If you don't enter into an accident throughout this period, the boost in the insurance deductible will be worth it. insurance company. If you do get right into a mishap, you will pay more out of pocket. It's finest to contrast cars and truck insurance coverage prices and review various other aspects with your insurance policy representative to find the appropriate remedy and make a notified choice.

If you spend just $300 on the protection, you would need a major discount to enjoy genuine financial savings, specifically in comparison to the price of submitting a high-deductible insurance claim. suvs. As an example, you can conserve around $30 every year when you pay a $1000 deductible in a claim. Why not select an option that assists you conserve $100 each year rather? It is very important to consider your scenario as well as discuss your options with your insurance coverage service provider to identify if the annual savings make good sense.

You have a $1000 deductible, which indicates you will have to pay $800 yourself. If you had a $100 insurance deductible, you would just have to pay $100 as well as conserve $700.

About How An Insurance Deductible Works

At the very same time, you may submit a lot more insurance coverage declares as well. It's truly approximately you to decide and evaluate all benefits and drawbacks. To resolve the high vs - vehicle insurance. low insurance deductible vehicle insurance conflict, you have to consider the number of car accident declares you have actually made in the past.

Make certain to think about the threats entailed. While saving some cash on your costs is great, it could set you back more to submit an insurance claim - cheapest auto insurance. Take right into account all the variables, including your driving document, which specify you live in, as well as the threat of natural disaster or criminal activity rate in your location.

Be sure to budget plan the deductible amount in your emergency situation financial savings. If you have to cover the repair service expenses with your credit score card, the high passion price will consume up the cost savings you might have obtained from increasing the insurance deductible (cheaper). Establish a long-term prepare for savings and also financial institution the money you conserve from the costs.

On the other hand, a driver with an inadequate driving record should go with a reduced deductible. Wondering how to examine my driving record? The most convenient method to inspect the driving document is by contacting your licensing office or neighborhood DMV. In enhancement, many states have made driving documents offered online.

The Comprehensive Auto Insurance Coverage - State Farm® PDFs

Choosing the ideal deductible amount, relying on your demands and also monetary scenario, can aid you save hundreds on your car insurance plan. If you choose in between an automobile insurance deductible of 500 or 1000, take into consideration various variables highlighted in this short article and also discuss your options with your insurance agent. vans.

Instead, do appropriate research study as there are other means to lower insurance costs. Your vehicle insurance representative can examine your scenario and also determine the ideal possible cost savings alternatives for you. cars. What is much better: a greater or reduced insurance deductible for cars and truck insurance coverage? If your car insurance coverage spending plan is limited, a high-deductible strategy could be preferable for you.

What is the best accident deductible? It's ideal to have a $500 crash insurance deductible unless you have a big amount of cost savings.

Allow's chat concerning deductibles. What is a deductible?

What Is A Deductible In Car Insurance? - Fox Business Fundamentals Explained

Your deductible is an up front out-of-pocket repayment The dollar amount of your deductible varies, based on the plan you and your American Household Insurance coverage representative choose together. All deductibles work the very same.

And also when they do, we'll be here to aid you every action of the method. Intend to find out more about exactly how deductibles function or what deductible quantity is best for you? Your American Family representative enjoys to help. American Household Insurance coverage Obtain a quote at.

Concerning Automobile Insurance Plan A car Insurance coverage policy or a motor insurance strategy is a contract between an insurance company as well as a car owner or any individual with an insurable passion in a car. In factor to consider for a premium paid by the policyholder, the insurance company guarantees to give monetary defense in case of any type of losses arising from a roadway mishap involving the vehicle, and from any third-party liabilities occurring from a case including the auto. car.

Yet this is a double-edged sword, as a greater voluntary insurance deductible would suggest a bigger amount to be paid out of your pocket when your automobile needs fixing. For that reason, you should choose only as much insurance deductible as you can pay for to pay of pocket. When going with a volunteer deductible, consider just how much can you pay without it having an influence on your other expenditures.

The smart Trick of Understanding Your Insurance Deductible - Martinsburg, Wv That Nobody is Discussing

Bear in mind that a partially greater costs can save you a great deal of frustration in case of an unpredicted mishap - credit. You do not need to bother with setting up for cash when you might currently be under significant stress and anxiety. Why Deductibles are used by Car Insurance Providers Cars and truck insurance policy providers think that deductibles incentivize the insurance policy holder to be responsible in their handling of the automobile.

As some of the expense of repair services will certainly need to be borne by the policyholder, she would be mindful in her use of the asset and, as a result, be able to use the automobile better (risks). Additionally, deductibles inhibit policyholders from submitting tiny cases minimizing overhead expenditures associated with working out an insurance claim.

Think about it similar to this: when a kid first gets a cycle, the moms and dads are worried about whether she would deal with the cycle. Some moms and dads inform their child that a component of the Find more information price of any repair work the cycle requirements will be cut from her spending money. vans. This makes the youngster act responsibly and also make sure that the cycle remains in excellent problem as high as feasible.

What is volunteer deductible in Automobile Insurance A voluntary insurance deductible is the quantity that would certainly have been paid by the insurance provider under usual problems, however you chose to pay it out of your pocket. Choosing to have a volunteer insurance deductible included in your insurance cover brings down your automobile insurance policy premium considerably.

The 7-Minute Rule for What Is A Car Insurance Deductible? - Promutuel Assurance

You will have to select just how much you are prepared to pay of your pocket at the time of plan proposal itself. The deductible would certainly be put on every insurance claim you submit in the policy duration. The insurer will only pay the component of the insurance claim amount that is above the overall voluntary and also required insurance deductible.

IRDAI policies have repaired the value of mandatory insurance deductible in car insurance coverage based upon the cubic capability of the cars and truck engine. Presently, it is established at 1,000 for cars with a cubic capacity as much as 1500cc, and at Rs 2,000 for better cubic capability. The mandatory insurance deductible does not have any effect on the auto insurance coverage premium.

When to select insurance deductible vehicle insurance? The amount of insurance deductible you go with depends upon your convenience level as well as the quantity of risk you are prepared to take. When choosing on a volunteer deductible, think about if you have a completely huge emergency fund readily available. You do not desire to deplete the fund, if it is small, when you can stay clear of the very same.

If you have a pricey lorry the premium for the car insurance coverage will be high. It may make sense to choose a little deductible so as to save money on the costs. Remember that you would anyways not make tiny insurance claims to accumulate your no claim benefit, so it would certainly be reasonable to go with a deductible equivalent to that quantity for which you would anyways not sue.

Not known Details About What Does Deductible Mean In Car Insurance?

Do you have to pay the insurance deductible if the fault is not yours? You just need to pay the insurance deductible on the case that is paid out by your insurance firm. If an additional celebration is discovered to be at fault, their insurance would certainly pay for the problems and also you will certainly not need to pay any insurance deductible.

Exactly how does insurance deductible works under auto insurance policy? An insurance deductible is the amount that you have to pay per case before the insurance provider pays for the rest. So, if you sue for Rs 10,000 as well as the deductible is Rs 1,000 the insurance company will just pay Rs 9,000 and also you will have to pay the rest out of your pocket.

You could also choose voluntary insurance deductible this does not have any type of top limit. What are the deductibles for business automobile insurance plan? The mandatory deductible for commercial car insurance coverage plan continue to be the very same as for individual automobile insurance coverage - auto. You can also select voluntary deductible based on your comfort to lower the cars and truck insurance policy costs.